http://www.businessinsider.com/how-americans-spend-most-of-their-money-2017-1 average income of $56,000

Eureka!

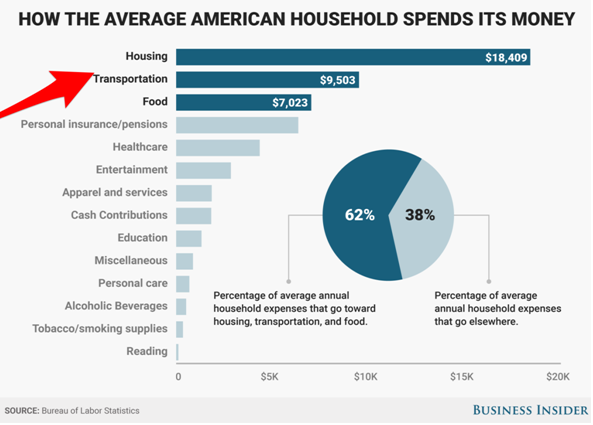

Saving money is not easy. But thankfully, by looking at the chart above, we know where the problems lie.

People are always talking about saving money on an everyday basis. (I am guilty of this too) …

“By cutting out the little things, we can find some pennies to save and eventually reach financial success.”

While that strategy might work if you cut out many, many things, you also have to be in it for the long haul.

Hypothetical Example:

Cutting out a $4 latte every day, will only save you around $1,500 a year and over 20 years, $30,000. If you build an investment portfolio that averages an annual 7% return, in 20 years you will have around $65,000.

Now that’s something, don’t get me wrong, but it’s not enough to let you ride off into the sunset.

How about you make a bigger splash!

Jump Into the Deep End

Do you ever feel that you are treading water with your finances? You track your money, you don’t go out for dinner all the time, you cut back on shopping, but you’re just not getting anywhere? You are not alone and I know why this is happening.

And you should probably sit down…

Of the money you track- the fixed bills, you have accepted. You only really track the “extras”, the “other” stuff. I know because I watch my clients do it every day. They have accepted their mortgage payment, the car payment, the cable payment, etc.. The big ticket items they accept but the little things they try to fix. It doesn’t make sense.

In reality, it’s their house that needs to be cheaper, their car that needs to be cheaper and their routine grocery bill that needs to be cheaper. That’s it. 3 things!

Are you guilty of this too?

Changing these things will save you tens of thousands of dollars per year.

But these are major disruptions… and disruptions = change = pain. and we try to avoid pain at all costs.

Get a One Page Financial Plan Here!

Solution

I understand that house and car payments are long term commitments and cannot be changed overnight. But that doesn’t mean you should just throw your hands up and give up…

What you need to do is put together a plan with action steps on how/when you can make the change. You need to build a financial plan that will show you how much you need to save for your future. Once you know that, you will have a much better idea of what kind of drastic change has to happen. Hopefully it’s not as bad as you think!

Maybe you can stay in the same town with just a smaller house. Or maybe you can you keep the same brand car but different model. There is only 1 way to find out.. You must do the research and build the plan!

And when it’s time to make the change, I promise it won’t feel as bad. You are not disrupting your life for bad reasons. Instead you have taken ownership of your financial future and made a commitment to stop treading water!

.As always, you can consult with me to discuss your current financial situation.

Look for future posts on the best ways to protect your family and check out my recent post on paying yourself first!

Lastly click here to sign up for all great stuff The Art of Financial Planning has to offer!

Thanks for stopping by and I hope you achieve financial success!