With markets whipping between rallies and retreats, it’s natural to ask:

Is it time to buy?

Is it time to sell?

Are we near the bottom?

Is the bear market finally over?

Despite the recent market surge, which propelled the Dow 21% higher in just 3 days (technically ending its bear market correction), it’s likely too soon to get overly optimistic.1

What gives? How can markets be rallying when the crisis hasn’t even peaked yet? When markets have fallen so much and “priced in” so much bad news, it’s common to see short-term surges on good news like the relief bill. However, these “head-fake” rallies can be unsustainable when there’s so much uncertainty.

Bottom line: No one is good enough to call the exact bottom of a market. What’s important is looking through the bear market to the other side and picking up opportunities along the way.

Whether the bear market is over or not, we’ve been here before and know what to do.

How worried should I be about a recession?

Cautious, but not panicked. When a $21 trillion economy comes to a screeching halt, there’s going to be an economic contraction. Multiple timely indicators show that we are already experiencing a sharp downturn.2

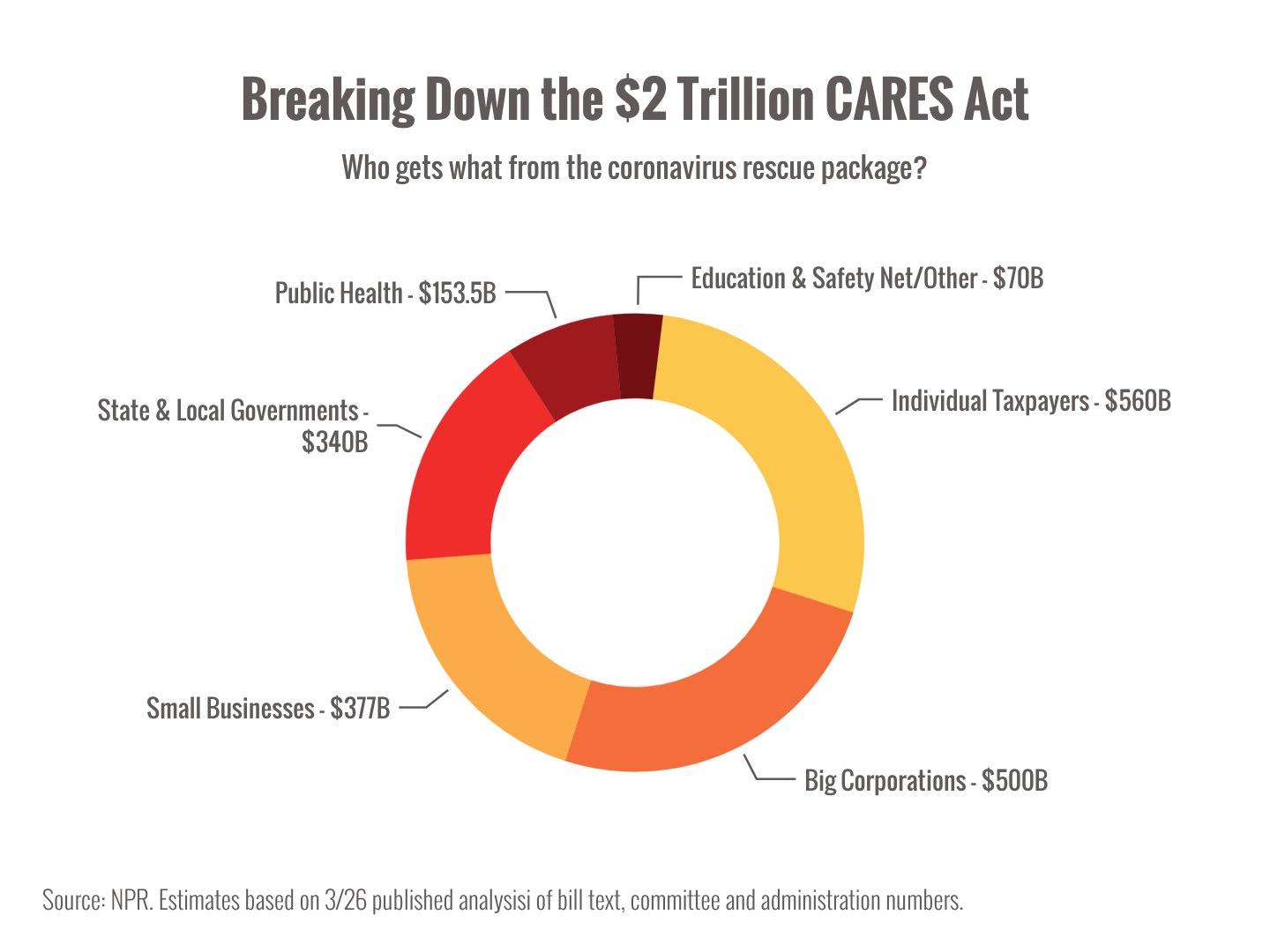

However, the $2 trillion fiscal rescue act and the Federal Reserve’s new asset-buying program are a double-barreled bazooka aimed at the effects of a serious recession.

We’re monitoring the data rolling in and will know more about how the economy is reacting to the unprecedented aid in the coming weeks and months.

What’s inside the $2 trillion CARES Act? What’s in it for me?

The Coronavirus Aid, Relief, and Economic Security (CARES) Act is designed to provide relief for individuals and businesses who have been hurt by the outbreak. I won’t try to include all 800+ pages in this email, but here are a few key provisions that you should know about:3

One-time cash payment. Taxpayers are eligible for a one-time direct deposit of up to $1,200 per adult ($2,400 per couple) plus $500 per child under age 16. Amounts are reduced for those who make more than $75,000 ($150,000 if married). If you have filed your 2019 taxes already, the IRS will use that income to calculate your payment; if not, they’ll use your 2018 tax filing.

Better unemployment benefits. The Act will extend and expand unemployment insurance through Dec. 31. Eligible workers (now including self-employed, independent contractors, and gig economy workers) will receive an extra $600/week for four months, on top of what they receive from state unemployment benefits.

Early withdrawal penalty waiver. The Act waives the standard 10% early withdrawal penalty for eligible coronavirus-related distributions from retirement accounts (retroactive to Jan. 1). You’ll still pay income taxes on withdrawals, but you can spread them over a three-year period or use that time to roll the distribution back over.

2020 RMDs suspended. You won’t have to take a Required Minimum Distribution from your IRA or 401(k) this year, leaving you in control of how much you withdraw. If you already took your RMD for 2020, you have several choices: keep it and pay taxes on it, return it to your IRA as an indirect rollover, or convert the amount into a Roth IRA (Roth conversions are permanent).

Take advantage of all that is available to you and keeping moving forward!