Life insurance is a crucial component of financial planning, providing a safeguard for your loved ones in the event of your untimely passing. However, navigating the world of life insurance can be complex, and many individuals make costly mistakes when selecting and maintaining their policies. Here, we’ll explore common life insurance pitfalls and provide a guide to help you secure the right policy for your needs. Each situation is different, so it’s always best to discuss your individual needs in person.

Underestimating Your Coverage Needs

One of the most frequent mistakes is not purchasing enough life insurance coverage. According to a 2022 LIMRA study, 106 million American adults are uninsured or underinsured regarding life insurance. This coverage gap can leave families vulnerable to financial hardship if the primary source of income dies unexpectedly.

Tip: Use the DIME method to calculate your coverage needs:

- Debt: Include all outstanding debts, including mortgages and loans.

- Income: Multiply your annual income by the years you want to provide for your family.

- Mortgage: Include the remaining balance on your mortgage.

- Education: Estimate future education costs for your children.

Add these figures together to get a baseline for your coverage needs. Remember, it’s better to err on the side of caution and have slightly more coverage than you think you need.

Waiting Too Long to Purchase Coverage

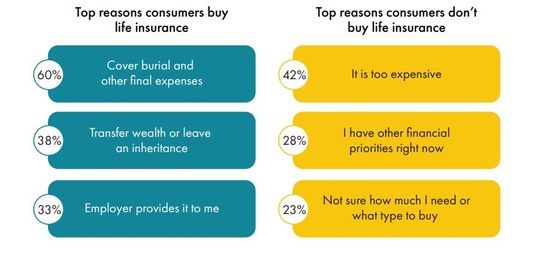

Many people put off buying life insurance until they’re older or facing health issues. This can result in higher premiums or even being denied coverage altogether. A 2022 LIMRA study found that 31% of Americans are more likely to buy life insurance due to the pandemic, indicating a growing awareness of the importance of early coverage.

Often, people put off purchasing life insurance because they believe it to be too expensive. However, acquiring life insurance earlier in life can be a more cost-effective way to protect loved ones, and there are many policies to choose from based on different budget needs.

Tip: The best time to buy life insurance is when you’re young and healthy. Premiums are generally lower, and you’re more likely to qualify for preferred rates. Don’t wait for a significant life event to prompt you into action – secure coverage now to lock in lower rates and ensure protection for your loved ones.

40% of policyholders wish they had purchased their policies sooner. (1)

Choosing the Wrong Type of Policy

Life insurance comes in various forms, with term and permanent (such as whole life and universal life) being the most common. Selecting the wrong type of policy for your needs can lead to inadequate coverage or unnecessary expenses.

Tip: Assess your long-term financial goals and current budget to determine the best policy type:

- Term life insurance is ideal for those seeking affordable coverage for a specific period, such as until children are grown or a mortgage is paid off.

- Whole life insurance: This product suits individuals seeking lifelong coverage with a cash value component and stable premiums.

- Universal life insurance: Offers flexibility in premium payments and death benefits, with the potential for cash value growth.

It’s always important we discuss your individual and changing needs to determine which policy best suits your unique circumstances and goals.

Neglecting to Review and Update Your Policy

Life circumstances change, and your insurance needs may evolve. Failing to review and update your policy regularly can result in inadequate coverage or paying for unnecessary features.

Tip: Set an annual reminder to review your life insurance policy. Key life events that may warrant policy updates include:

- Marriage or divorce

- Birth or adoption of a child

- Purchase of a new home

- Career changes or significant income fluctuations

- Changes in health status

By keeping your policy up to date, you ensure that your coverage continues to meet your family’s needs as your life evolves.

Overlooking Riders and Additional Benefits

Many life insurance policies offer optional riders or additional benefits to enhance your coverage. Failing to consider these options may result in missed opportunities for valuable protection.

Tip: Explore common riders and assess their relevance to your situation:

- Accelerated death benefit: Allows you to access a portion of your death benefit if diagnosed with a terminal illness.

- Waiver of premium: Waives premium payments if you become disabled and unable to work.

- Child rider: Provides coverage for your children under your policy.

- Long-term care rider: Offers benefits to cover long-term care expenses.

Misunderstanding the Importance of Medical Exams

Some individuals avoid life insurance that requires medical exams, opting for no-exam policies instead. While convenient, no-exam policies often have higher premiums and lower coverage limits.

Tip: Don’t shy away from policies requiring medical exams. A medical exam can help you secure better rates and higher coverage limits if you’re healthy. Neglecting to Name Contingent Beneficiaries

While most people remember to name a primary beneficiary, many forget to designate contingent beneficiaries. This oversight can lead to complications if the primary beneficiary predeceases the insured or cannot receive the benefit.

Tip: Name at least one contingent beneficiary on your life insurance policy. Review and update your beneficiary designations regularly, especially after significant life events such as marriages, divorces, or births.

Surrendering Permanent Policies Prematurely

Permanent life insurance policies, such as whole or universal life, can accumulate cash value over time. Some policyholders surrender these policies prematurely, missing out on potential long-term benefits.

Tip: Before surrendering a permanent life insurance policy, consider alternatives such as:

- Taking a loan against the cash value

- Using the cash value to pay premiums

- Reducing the death benefit to lower premiums

Relying Solely on Employer-Provided Coverage

Many individuals assume that the life insurance provided by their employer is sufficient. However, employer-sponsored policies often offer limited coverage and may not be portable if you change jobs.

Tip: View employer-provided life insurance as a supplement to your policy, not a replacement. Consider purchasing an individual policy to ensure consistent, portable coverage that meets your long-term needs.

Misunderstanding Policy Exclusions and Limitations

Failing to read and understand policy exclusions and limitations can lead to unexpected gaps in coverage. Common exclusions may include death by suicide within the first two years of the policy or death resulting from dangerous activities.

Tip: Carefully review your policy’s terms and conditions, paying close attention to exclusions and limitations. If you have questions or concerns, don’t hesitate to ask your insurance agent or financial advisor for clarification.

Overlooking the Impact of Inflation

Inflation may decrease the purchasing power of your life insurance benefit over time. According to a 2022 LIMRA study, only 49% of Americans feel financially secure, highlighting the importance of considering inflation when planning for the future.

Tip: Consider an inflation rider or regularly reviewing and increasing your coverage to ensure your policy’s death benefit keeps pace with rising living costs.

Failing to Understand the Tax Implications

While life insurance death benefits are generally tax-free for beneficiaries, there can be tax implications in certain situations, such as when a policy is surrendered or when taking loans against cash value.

Tip: We can help you understand the potential tax implications of your life insurance policy and how to structure it most efficiently within your overall financial plan.

Procrastinating on the Application Process

The life insurance application process can take several weeks, especially if medical exams are required. Procrastinating on starting the process can leave you and your family unprotected longer than necessary.

Tip: Once you’ve decided to purchase life insurance, begin the application process promptly. Many insurers now offer accelerated underwriting options that can significantly speed up the process for qualified applicants.

Neglecting to Secure Coverage for Stay-at-Home Parents

The economic value of a stay-at-home parent is often underestimated. Failing to secure life insurance for a non-working spouse can leave families struggling to cover childcare and household management costs in the event of their death.

Tip: Consider the cost of replacing the services provided by a stay-at-home parent when determining life insurance needs. Include childcare, home management, and other relevant expenses in your calculations.

Avoiding these common life insurance mistakes can help ensure that you and your loved ones are adequately protected. Life insurance is not a one-size-fits-all product; your needs may change over time. Regular reviews with a qualified financial advisor can help you stay on track and make necessary adjustments to your coverage.

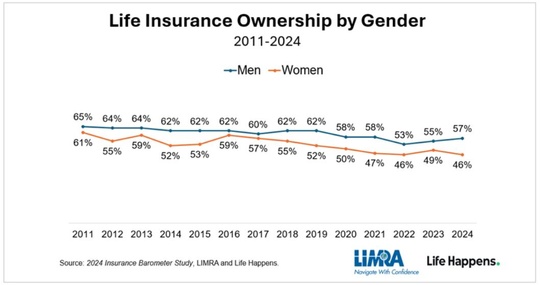

As you navigate life insurance’s complexities, remember that education is key. A 2022 LIMRA study found that 73% of Americans agree that life insurance is an important part of financial planning, yet only 52% own a policy. Understanding the common pitfalls and following the tips can bridge this gap and secure the right policy for your needs.

Don’t let uncertainty or misconceptions prevent you from obtaining the protection your family deserves. If you need to assess or reassess your life insurance needs, let’s discuss and take action today to review and ensure you have the right coverage for a secure financial future.

LIMRA, 2020 Insurance Barometer Study

LIMRA, 2021 Insurance Barometer Study