As inflation rises through this bear market, it’s easy to forget its role in our economy and how it affects consumers.

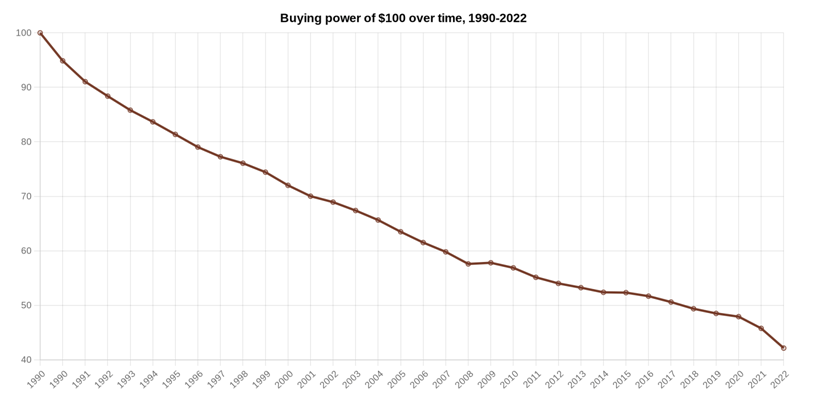

If you had $100,000 in cash a year ago, it would have been worth $91,400 in June 2022.

The purchasing power of your dollar has declined 8.6% in one year.

This is inflation.

In this article, you’ll discover everything you need to know about inflation, from what it is to how it affects consumers.

You’ll also find a history of inflation, how it’s calculated and what the future might hold.

Key takeaways

- Inflation is a decrease in the purchasing power of money.

- If you don’t own assets, inflation makes you poorer. If you own assets, inflation makes you richer.

- Prices fluctuate, but inflation is sustained increases in the cost of goods and services.

- In the US, the official measure of inflation is the Consumer Price Index (CPI).

- Inflation can be caused by several factors, including the economy, monetary policy, and global economic conditions.

- Inflation will remain relatively stable with an upward trend in the long term.

What is Inflation?

Inflation is defined as a general increase in prices and a fall in the purchasing power of money. When inflation rises, every dollar you own buys a smaller percentage of goods or services.

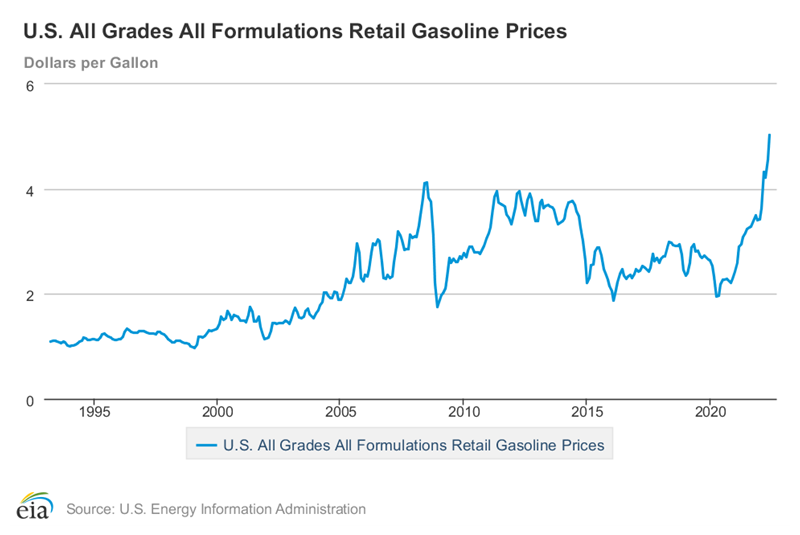

A good illustration is to consider the price of a gallon of gasoline.

In June 1990, the price of a gallon was $1.30.

Thirty-two years later, in June 2022, the price was $4.68 per gallon.

In other words, gasoline prices have more than tripled since 1990.

To put this in perspective, if you had $100 of gasoline in 1990, it would be worth $360 today.

The value of your gasoline has fallen by more than two-thirds.

Note: The difference in the price of goods is not always directly related to inflation. The cumulative inflation rate between 1990 and 2022 is 123.6% while gasoline prices changed by 360%.

How Does Inflation Affect Consumers?

Inflation affects consumers in a few ways—both negatively and positively.

Price of Goods Increase

The most direct way inflation affects consumers is through the prices of goods and services when the prices of everyday items increase, the purchasing power of consumers decreases.

This is why, as we noted earlier, the value of $100 a year ago would be worth only $91.40 in June 2022.

In other words, your dollar can’t buy as much now as it could a year ago.

Wages Increase Relatively

The second way inflation affects consumers is through wages. In general, when inflation goes up, wages rise as well.

Workers need to be paid more to cover the increased cost of living.

But there is a lag between inflation and wage growth. So, for example, if the cost of living increases by 3% in a year, wages might only grow by 0.60% in that same year.

This lag can cause a temporary decrease in purchasing power for workers, as their wages don’t keep up with inflation.

Interest Rates Increase

The third way that inflation affects consumers is through interest rates. When inflation is high, the Federal Reserve will often raise interest rates to help keep it under control.

Higher interest rates mean consumers will have to pay more for loans, such as mortgages, car loans, and credit cards.

This can lead to decreased purchasing power and a higher cost of living.

Asset Prices Increase

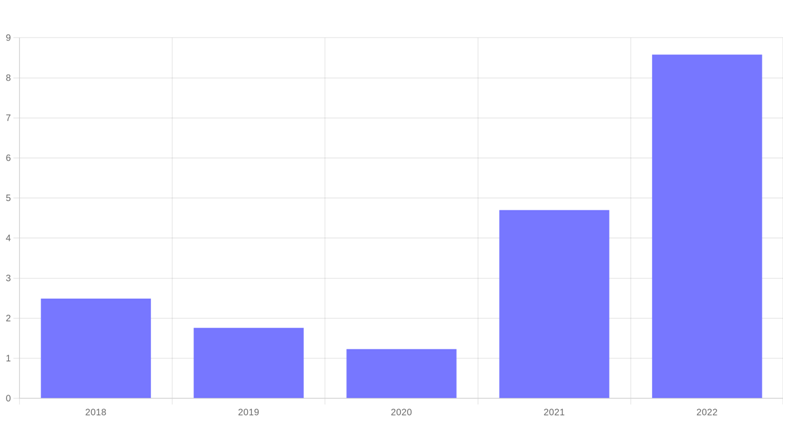

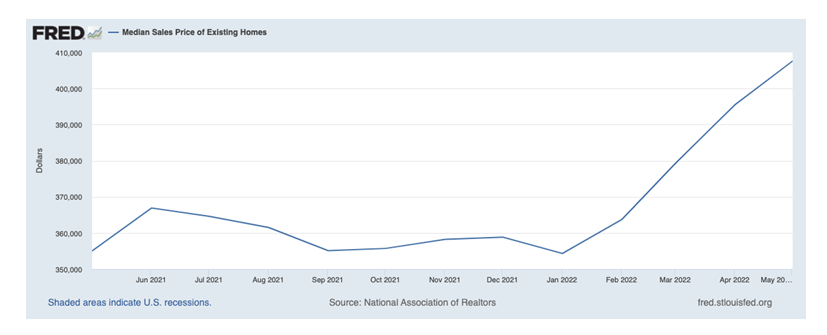

The fourth way that inflation affects consumers is through asset prices. When inflation is high, the prices of assets such as real estate tend to rise.

This is because investors know the purchasing power of their money is declining, and they need to invest in assets that will keep up with inflation.

Prices go up as the demand for assets skyrockets with less sell intent.

For example, a median home sale price of $347,900 in 2021 can skyrocket to $434,600 in just a year with an 8.6% inflation rate.

This is why it’s a good idea to invest in assets anytime.

History of Inflation

Inflation has been a part of the US economy since its inception.

The highest recorded instance of inflation was in 1778, with a 29.78% inflation rate, just two years after the founding of the United States.

Since the introduction of the CPI, the US’s highest inflation rate observed was 20.49% in 1917.

In contrast, the lowest recorded instance of inflation was in 1921, with a -15.80% inflation rate.

Inflation averaged 3.15% between 1913 and 2020, with a 2,852.48% cumulative inflation.

The Great Depression

Between 1929 and 1933, the US saw its worst bout of inflation with a -6.62% average inflation rate. And 23.98% cumulative inflation.

This was due to the Great Depression, which decreased demand and increased the money supply.

The result was a decrease in prices, which led to deflation.

The 1970s Stagflation

In the 1970s, the US experienced what is known as Stagflation. This is a combination of high inflation with disappointing economic stagnation.

The cumulative inflation rate during this time was 112.37% in 1980.

This was caused by several factors, including the oil crisis and increased government spending.

These inflation occurrences were the premise for several regulatory policies and organizations, including the Federal Reserve.

Causes of Inflation

Inflation is caused by several factors, both internal and external.

Internal causes of inflation include:

- A decrease in the supply of goods and services

- An increase in government spending

- An increase in the money supply

External causes of inflation include:

- An increase in the price of imported goods

- A decrease in the value of the US dollar

- A decrease in productivity

Several other factors can also cause inflation:

- wars,

- natural disasters, and

- political instability

How is Inflation Calculated?

The most common metric for calculating inflation is the CPI (Consumer Price Index).

Each year the Bureau of Labor Statistics (BLS) calculates the CPI by surveying a “market basket” of common consumer goods and services.

This market basket includes housing, food, transportation, and healthcare items.

The CPI is then calculated by taking the cost of this market basket and comparing it to the cost of the same market basket in a previous year.

For example, if the cost of the market basket in 2017 was $100 and the cost of the market basket in 2018 was $105, the CPI would be 5%.

The CPI is then used to calculate the inflation rate.

CPI Calculating Between Years

To calculate inflation between years, you need two numbers:

- The Consumer Price Index (CPI) for a specific year

- The CPI for the base year

You can find both numbers on the Bureau of Labor Statistics website.

The CPI measures the average price change paid by consumers for a basket of goods and services.

The CPI for the base year is set to 100. So, if the CPI for a specific year is 120, prices have increased by 20% since the base year.

To calculate the inflation rate for a specific year, you would use the following formula:

- Inflation Rate = (CPI for Specific Year – CPI for Base Year) / CPI for Base Year

For example, let’s say that the CPI for the base year is 100 and the CPI for a specific year is 120.

To calculate the inflation rate, you would use the following formula:

Inflation Rate = (120 – 100) / 100

Inflation Rate = 20%

Other Measuring Tools

The Wholesale Price Index is another common tool for measurement. This index measures the changes in prices of goods at the wholesale level.

Another measurement tool is the Producer Price Index (PPI). While the PPI measures and compares price increases from the seller’s standpoint, the CPI compares from the buyer’s standpoint.

Changes in Inflation Over Time

Inflation has changed significantly over time. In the early 1900s, inflation was relatively low.

However, it spiked in the 1920s and 1930s during the Great Depression.

Inflation then remained relatively low until the 1970s, when it spiked again.

Since the 1980s, inflation has remained relatively stable.

What Does the Future Hold for Inflation?

The future of inflation is difficult to predict. However, most experts believe that inflation will remain stable in the coming years.

This is due to several factors, including the current state of the economy, the Fed’s monetary policy, and global economic conditions.

While there is always the potential for sudden spikes in inflation, most experts believe that the overall trend will remain relatively stable.

The Bottomline

In the broader picture, inflation is inevitable. While several factors can cause inflation to spike, it is generally a slow and gradual process.

Some ways to protect yourself from inflation include investing in assets that have the potential to appreciate.

You can also hedge against inflation by purchasing commodities, equities or investing in real estate but those will go through boom and bust cycles.

Ultimately, the best way to protect yourself from inflation is to have a diversified portfolio that can weather the ups and downs of the economy.