After reaching more new highs recently, markets have pulled back and gotten choppy.

Let’s break down what’s happening and why it matters.

What’s driving recent volatility?

Concerns about the impact of inflation and tariffs on consumer sentiment are one major driver. If Americans lose confidence in the economy, they may pull back on spending, which is the biggest driver of economic growth.

Federal workforce reductions are also adding to the uncertainty. The new administration has implemented significant changes by laying off thousands of newer employees and offering buyouts to many more.

It’s not yet clear what the long-term effect of these job cuts may be, but the impact may radiate out to other areas of the economy if workers can’t find new jobs and households cut back spending.

If you or someone close to you has been impacted by layoffs, please reply to this email and let me know. We can navigate the financial changes together.

Why we are cautiously optimistic about markets despite the uncertainty

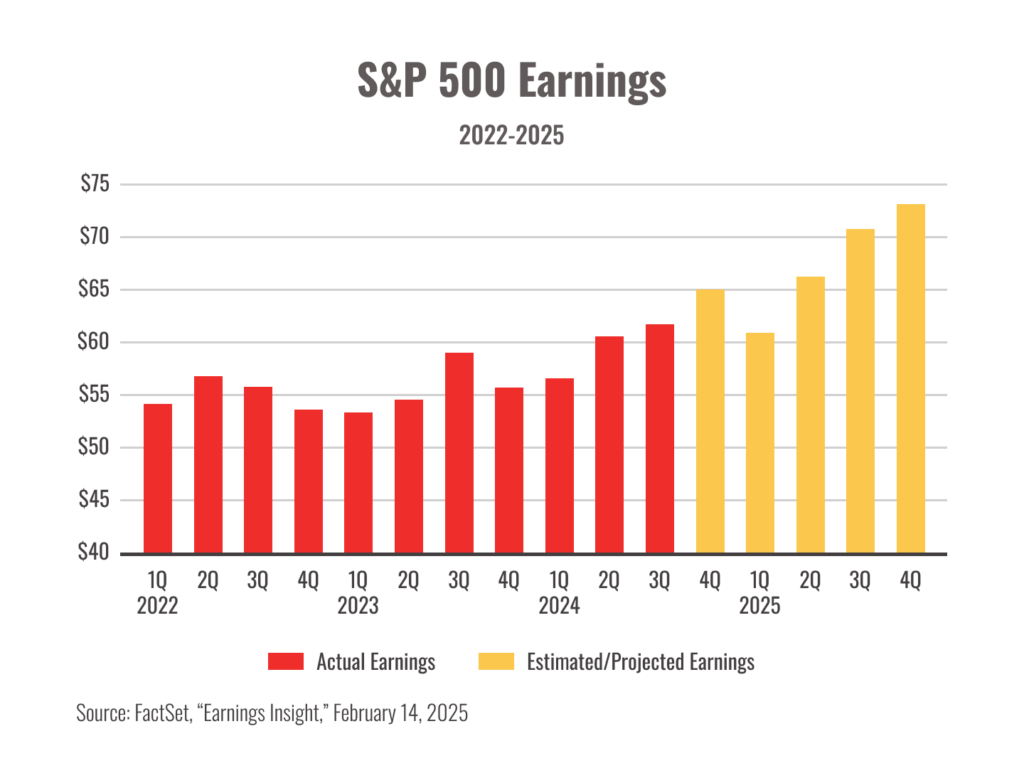

The good news is that Q4 corporate earnings look very positive so far. If trends continue, we could see the largest year-over-year earnings increase since 2021.

Many companies are also reporting better-than-expected results, suggesting business conditions were stronger than anticipated.

With today’s high stock valuations, continued earnings performance remains critical for market growth. If business performance doesn’t keep up with expectations, we can expect a pullback.

What does this mean for your portfolio?

As you already know, pullbacks and volatility are a normal part of investing, especially during periods of major uncertainty.

When we built your portfolio together, we designed it to help weather these kinds of fluctuations while positioning you to pursue your goals.

When markets retreat, and you start to get nervous, it’s natural to wonder if you should be in the market at all.

It’s a completely normal experience as an investor. But letting your feelings drive your investment decisions doesn’t typically yield great results. In fact, it often accomplishes the opposite.

Abandoning your strategy when markets get choppy and uncertain may mean locking in losses and potentially missing out on future market opportunities.

But it doesn’t mean we hold fast to a strategy that no longer fits current conditions. That’s where my team and I are working hard.

We’re monitoring developments closely. We can’t predict the future, but we can use data and experience to help you chart a course. Onward!