The stock market is already a little crazy this week.

Is a storm coming?

Let’s take a look at what’s driving markets right now.

(Scroll to the end if you just want my takeaways.)

A few things are driving the market volatility:

Fears of a financial crisis in China.

China’s overheated real estate bubble is starting to pop and Evergrande, a giant Chinese property developer, is heading toward defaulting on more than $300 billion in debt.1

Its failure could trigger a cascade of defaults among banks, materials suppliers, and investors, potentially leading to broader financial issues in China and abroad.

Worries the Federal Reserve will start tapering soon.

The Fed meets this month and traders are uneasy about the idea that the central bank could start pulling back the support now that inflation is higher and the jobs market has improved.2 Firms that depend on low interest rates and easy credit could be hurt.

Concerns about COVID-19 case numbers.

Variants continue to pop up and the delta variant continues to keep cases and hospitalizations high. Investors are concerned that another winter resurgence (like we saw last year) could slow down business and economic activity.3

Fears of another debt ceiling showdown.

Once an ordinary part of federal accounting, adjusting the debt ceiling is now a political negotiation, threatening the Treasury Department’s ability to pay its bills next month.

Though it’s unlikely either party will allow the U.S. to default on its obligations, this political brinksmanship adds anxiety each time it comes up. Another government shutdown could exacerbate political risks to markets.4

Do you see a trend? Markets are being driven by fear, anxiety, and doubt.

Which of these squalls will fade away and which could blow into a tempest?

We can’t know.

So, here’s the real question:

Could we see a 10%+ correction in the weeks or months ahead?

Possibly.

Corrections and pullbacks happen regularly and it wouldn’t be surprising to see a market drop.

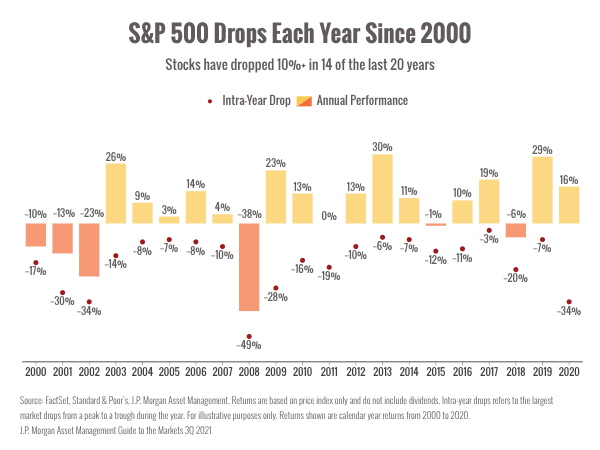

To show you just how ordinary corrections are, here’s a chart that shows intra-year dips in the S&P 500 alongside annual performance.

(Take a look at the red circles to see the market drops each year.)

The big takeaway? In 14 of the last 20 years, markets have dropped at least 10%.5

Even years with strong performance saw big drops.

We’re dealing with a lot of uncertainty and investors are feeling understandably cautious about what’s ahead.

But, that doesn’t mean that we should panic and rush for the exits.

Pullbacks, corrections, and even downturns don’t last forever.

Trust your process. Trust your strategy. And if you don’t have either one…..what are you doing????

3https://www.cnbc.com/2021/09/19/stock-market-futures-open-to-close-news.html

4https://www.nytimes.com/2021/09/20/business/stock-market-federal-reserve.html