Death is an inevitable future. Life insurance provides a safety net for your family or dependents after you’re gone.

- 53% of households without life insurance say that they wouldn’t be financially secure if the primary income earner suddenly passes away.

- As of 2021, only 52% of Americans had life insurance.

- 40% of people with life insurance wish they had bought their policies when they were younger.

- 50% of Americans overestimate how much life insurance costs.

- The average cost of a life insurance premium for a person who’s 50 is more than twice as expensive as it is for a 20-year-old.

There’s something about the term ‘life insurance” that makes some people cringe, especially if they’re young and healthy. However, let’s face it. We’re all going to die someday.

As such, avoiding the conversation isn’t going to do you or your loved ones any good.

That being said, life insurance is the most solid form of insurance because you’re protecting your family against a risk that is bound to happen. Let’s face it.

And with a life insurance plan in place, you have everything ready to protect your legacy and loved ones.

Still in doubt? Then let’s dive into the reasons why you need life insurance even if you are young and healthy.

What Is Life Insurance And How Does It Work?

Life insurance is a contract between an insurance company and a policyholder – you. In it, the insurer, in exchange for a premium, promises to pay a specific amount of money, known as the “death benefit,” to your beneficiaries after you die.

Here’s how it works. After purchasing a life insurance policy, you’ll need to pay premiums annually or monthly to keep your insurance coverage active. Failure to pay the premium would cause your coverage to lapse.

If you die while your coverage is still active, the insurance company would pay a tax-free lump sum to the individuals you named as your beneficiaries.

When entering into this contract, you can stipulate how the death benefit should be paid out and out and whether it’ll cover specific expenses, like mortgage or rent. Alternatively, you can decide just leave it to your family as an inheritance.

In the case of the latter, your beneficiaries determine what the money can be used for.

Upon your death, your beneficiaries will have to complete a death claim form and submit it to the insurance company to get the death benefit.

Life insurance is part of the foundation of a solid financial plan. This is because you’re securing your future against debts and providing financial support for your dependents after your demise.

Term Life Insurance vs. Universal Life Vs. Whole Life.

There are three major types of life insurance. Let’s discuss each of them in detail.

Term Life Insurance

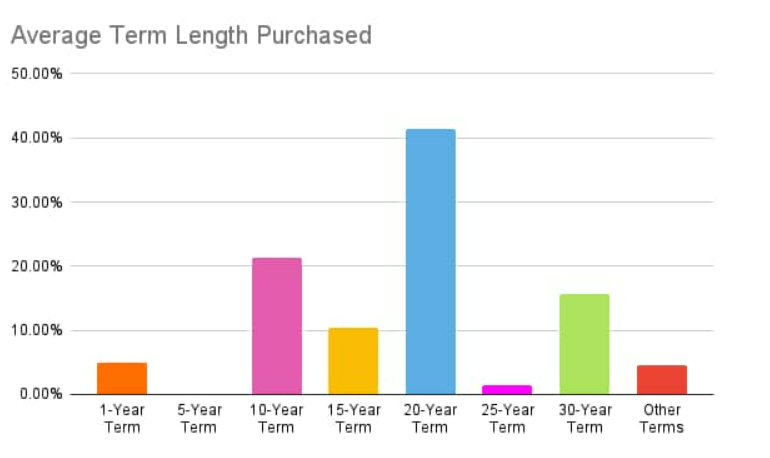

Term life insurance refers to a short-term insurance policy. Here, your agreement with the insurance policy is to run for a fixed term. The insurance company only pays if you die within the time the policy is to run.

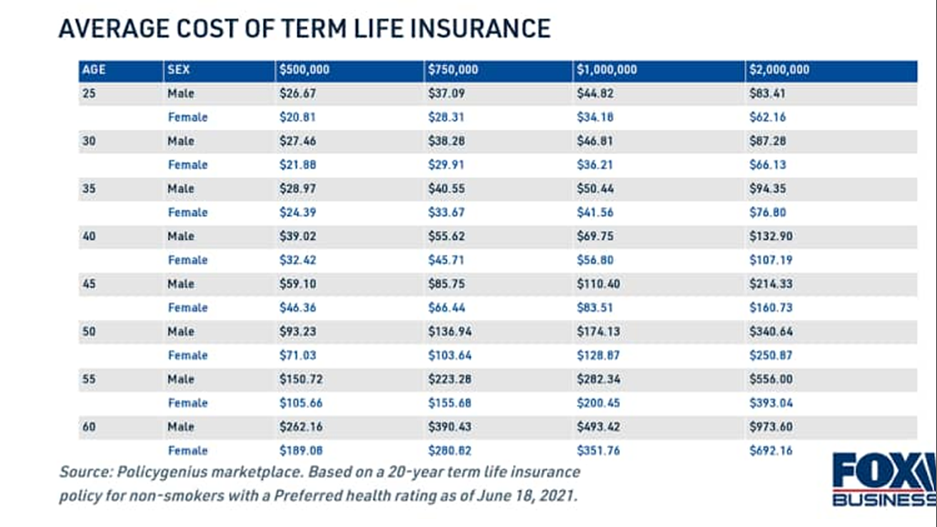

Term life insurance is more affordable when you’re younger and healthier with less death risk. However, as you grow older, with more health risks, the prices increase.

For instance, let’s say you can pay a premium of $30 for term insurance when you are 25 years old. By the time you’re 50, the amount could have increased to $60.

The downside to this type of insurance policy is that the insurance company only pays when you die within the time frame or ‘term’ of this policy.

Universal Life Insurance

This insurance policy gives you a double offer. It includes a savings plan with the death benefit, which you can withdraw from in the future.

These savings are usually tax-deferred. That means you can pay tax on it at a later date instead of upfront.

When you’re younger, a greater percentage of the premium goes into savings. And as you grow older, a greater percentage goes into the death benefit.

For example, if your universal life insurance were $150 at age 22, $100 could go to the death benefit and $20 to savings. Then at 65 years, it becomes $250; $200 would go to the death benefit, while $50 would go to savings.

The advantage of this type of life insurance is that it is flexible, and you’re able to make adjustments as you go.

Whole Life Insurance

Whole life insurance is designed to cover you till you die, whenever that happens. It provides a permanent cover, and the insurance company pays as long as you keep up with premium payments before you die. It offers lifetime protection.

The premium is a fixed amount that doesn’t increase, so it is good to buy one when you’re younger. It’s even more affordable for you as you grow older.

Why Should You Buy Life Insurance?

Whether you’re young or older, you need life insurance if you have anyone who relies on your income. This includes children, a spouse or partner, and loved ones who live in a house with a mortgage you pay.

You don’t want to leave the people you care about in a financial crisis if you suddenly die. You want to ensure that they’re well provided for.

Life insurance helps you pay off student loans, mortgages, and any debts you might have acquired during your lifetime. In doing so, your dependents do not have to be burdened with this responsibility.

Additionally, you need life insurance to provide for your dependents or loved ones after you’ve gone. The death benefit would substitute and replace the income you’re no longer able to provide.

Other expenses that life insurance can cover include:

- College tuition and costs

- Living expenses for your family

- Funeral expenses

- Estate taxes that your beneficiaries need to pay for other assets

- Charitable donations

- Medical expenses

That said, it’s evident from our discussions so far that getting life insurance while you’re young is better as it’s more affordable

The more you age, the more the cost because your health will naturally decline. Also, at a young age, you likely haven’t incurred much debt or have lots of dependents under you. So it’s easier to take an insurance cover and start at your capacity and then build up from there.

How Much Cover Do You Need?

You need as much cover as you need from a life insurance policy.

In choosing a life insurance policy, think about how much money your dependents will need when you’re gone. Your insurance cover should be enough to replace your income with some extra to cover inflation.

As a general rule, your insurance cover should be 6 to 10 times more than your income or salary. In calculating this, you should include debts, inflation, mortgage, and income). If you have debts, mortgages, student loans, car loans, etc., you have to factor that into your insurance cover.

Using the 10x rule, if your yearly salary is $20,000, then you need an insurance cover of $500,000. You should also add an extra $100,000 to guide against inflation.

There’s also the human value approach, where you calculate your coverage based on the standard of living you want your dependents to maintain. To calculate this, first figure out how much your dependents will need to survive after you’re gone. Then multiply that amount by 20. This will give them enough to withdraw yearly and also invest the death benefit principal.

So don’t wait; your health can change overnight! Buy a life insurance cover today; you’ll be glad you did.