Will my kids have it as good?

My parents gave me the world. ‘

Toys, gadgets, expensive vacations, sleep away camp, etc.

It was so good.

I had no idea of the cost of that goodness.

My parents argued about money regularly, but rarely brought it down to my level. So I was ignorant of the dollars and cents.

Now that I am a father of 1, with #2 on the way I see the cost of raising a child first hand.

And, as my children grow, I want to be able to provide them with the same type of lifestyle I had growing up. (see above)

However, as a financial planner I know how to run the numbers. And the numbers aren’t pretty.

Diapers, formula, day care etc…the costs are already piling up.

Stats:

According to the US Department of Agriculture the cost to raise a child in the 80’s to age 18 was roughly $195,281

Today that cost is $291,500

Run your own scenario here-

(not endorsed by IFS)

That’s a 49% increase.

A 49% increase over 35 years doesn’t seem so bad..That’s about 1.4% increase per year.

But then there is this study…

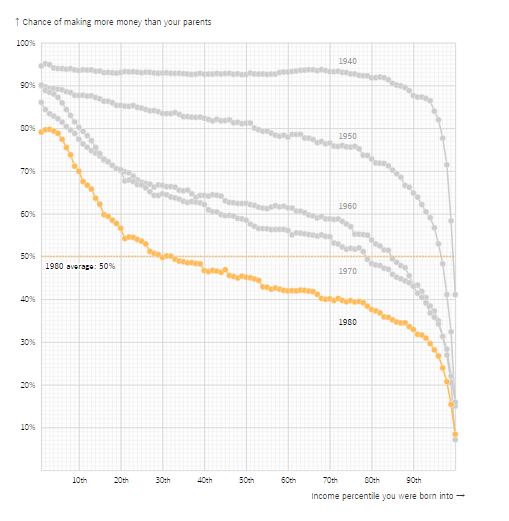

The American Dream Quantified at Last

NY Times OP-ED columnist David Leonardt back in DEC 2016 wrote a great piece about the cost of the American Dream.

He writes:

“These days, people are arguably more worried about the American dream than at any point since the Depression. But there has been no real measure of it, despite all of the data available. No one has known how many Americans are more affluent than their parents were — and how the number has changed.”

For me

“In the 1980s, economic inequality began to rise, a result of globalization, technological change, government policies favoring the well-off and a slowdown in educational attainment and the work force’s skill level. Together, these forces pinched the incomes of the middle class and the poor. The tech boom of the 1990s helped — slowing the decline of the American dream — but only temporarily.

For babies born in 1980 — today’s 36-year-olds — the index of the American dream has fallen to 50 percent: Only half of them make as much money as their parents did.”

So it boils down to, the cost of raising a child has risen by 50%,

and

there is a 50% chance I will not make as much money as my parents, which we can assume is the amount of money needed to provided a similar lifestyle, if not more…

The numbers are stacked against me.

What do you do when the numbers aren’t very good?

The same thing I tell my clients when they are behind on their college savings, or retirement plans-you have to change the game.

The picture of the American Dream, or more specifically to me, the lifestyle I had growing up will need to be changed.

And that’s ok!

Game Change

To me the answer is to learn to live with less “stuff.”

Stuff isn’t important. Memories and experiences are.

I want to provide my children with a safe environment for them to learn and grow into respectable and kind human beings.

That doesn’t mean I have to battles the neighbors for the nicest car or compete with their friends for the hottest video games.

But instead I have to support them, care for them, and teach them the tools needed to succeed in life.

Hope

I began this post with this:

“My parents gave me the world. ‘

Toys, gadgets, expensive vacations, Sleep away camp, etc.

It was so good.”

35 years from now I hope my kids will say the same – first and last line above…

As always, you can consult with me to discuss your personal financial situation.

Look for future posts on the best ways to on the best ways to protect your family and check out my recent post on retirement income planning

Lastly click here to sign up for all great stuff The Art of Financial Planning has to offer!

Thanks for stopping by and I hope you achieve financial success!