It’s well known that stocks are one of the foundations of long-term portfolios. When included as part of a comprehensive financial plan, stocks have historically created wealth and helped investors achieve their financial goals. However, a natural question is: what type of stocks? While investors and the media tend to focus on the stocks of the largest companies, there are many other categories that can play important roles in diversified portfolios.

The stock market is often seen as synonymous with the S&P 500 or Dow Jones Industrial Average. The S&P 500 is an index that tracks the performance of the 500 largest publicly traded companies, weighted by market capitalization, a measure of company size. The Dow is an index that includes only 30 large, well-established companies. Both consist primarily of companies that are incorporated and headquartered in the United States.

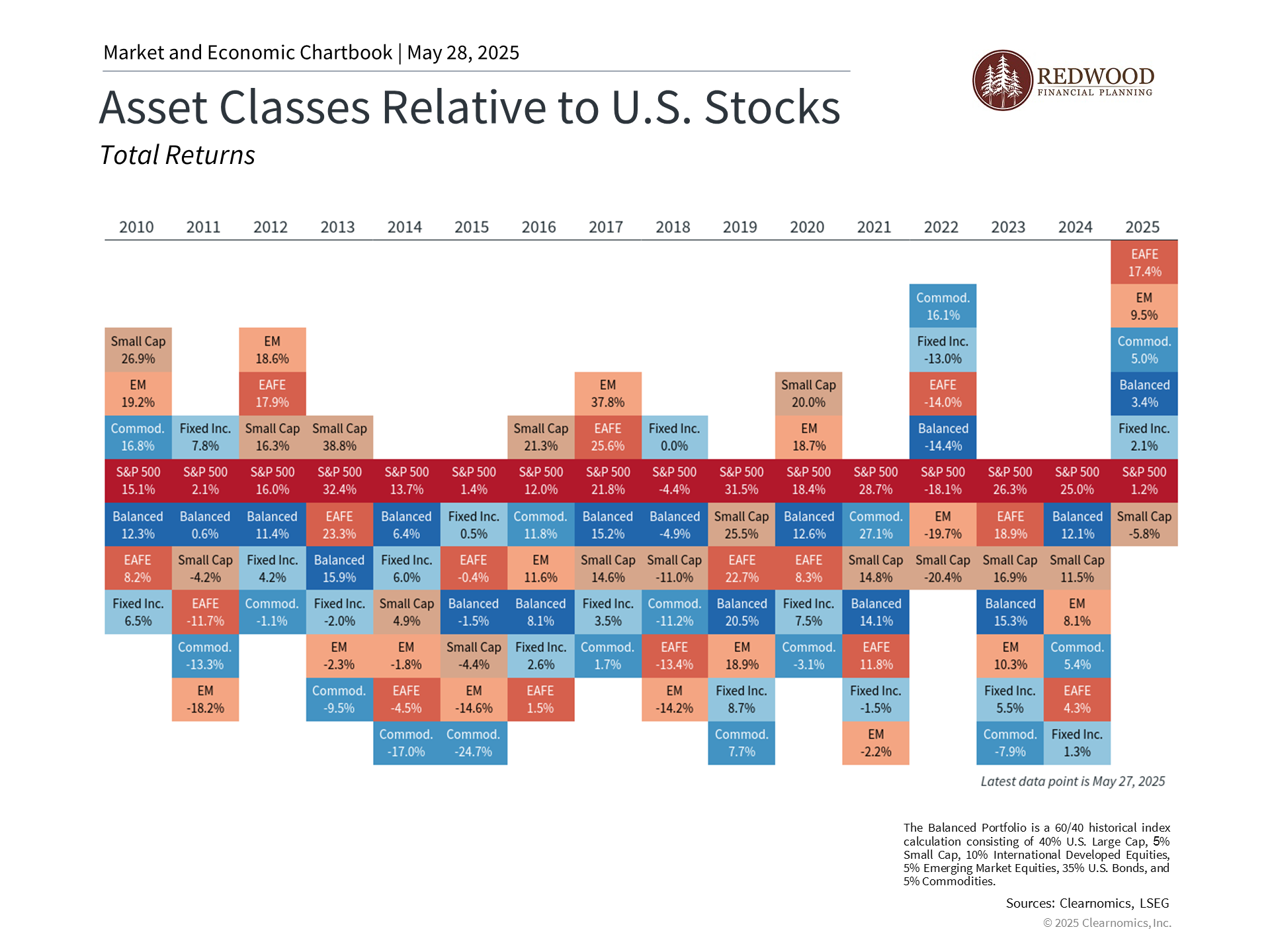

So, due to the way they’re constructed, these indices focus only on the largest U.S. companies. This can be helpful when trying to understand the overall stock market and economy, since the largest companies are what drive those trends. However, when building portfolios, these indices may overlook other areas of opportunity. This is especially relevant when a handful of “mega cap” stocks, including those in the Magnificent 7, have been the primary drivers of both positive and negative returns.

In this market environment, how can investors broaden their perspective? Small-cap stocks and international markets are two examples of areas that can provide opportunities and diversification. Each offers distinct characteristics and potential benefits that can enhance portfolio diversification, especially during times of market volatility and economic uncertainty.

Small caps have lagged but offer diversification benefits

Small-cap stocks represent companies with market capitalizations typically ranging from a few hundred million to a couple billion. This contrasts with mid and large-cap companies that range from tens to hundreds of billions, and mega caps which are now valued in trillions of dollars.

The Russell 2000 index, which tracks small-cap performance, has generated 5.0% annualized returns over the past decade compared to 10.5% for the S&P 500, as shown in the accompanying chart.1 This performance gap has been particularly pronounced in recent years as the market concentration from large and mega cap companies has increased, especially in technology and artificial intelligence-driven sectors. Small-cap companies typically have less exposure to the technology sector and derive more of their revenue from domestic operations, making them sensitive to changes in U.S. economic policy and trade conditions.

Notably, small caps have struggled so far this year due to ongoing uncertainty around tariffs and economic growth. However, this has created potentially attractive valuations. Small-cap stocks are currently trading at more reasonable price-to-earnings ratios compared to large-cap stocks. The Russell 2000 currently has a price-to-earnings ratio well below its 10-year average. More striking is the price-to-book value of approximately 0.8x, considerably lower than the historical average of 1.2x. In comparison, many of the S&P 500’s valuation metrics are well above average, if not near all-time highs.

The interest rate environment is another important difference between large and small-cap companies. Small caps often rely more heavily on financing from floating rate debt than their large-cap counterparts, making them more sensitive to interest rate fluctuations. While this created challenges when interest rates rose rapidly beginning in 2022, the more stable environment since then could help. This is especially true if the Fed continues to cut rates later this year.

Many of these metrics point to the fact that small-cap stocks are more attractively valued than many other parts of the market. While large caps will continue to play an important role in many portfolios, this highlights the fact that there are opportunities in many other parts of the market as well.

International markets continue to be attractively valued

Another area of attractive valuations is international stocks, which are typically categorized into two main segments: developed markets (such as Europe, Japan, and Australia) and emerging markets (including countries like China, India, and Brazil). These classifications reflect differences in economic maturity, market infrastructure, regulatory frameworks, and more.

Although U.S. stocks have led global markets for much of the past decade, international stocks have outperformed this year. Specifically, the MSCI EAFE index, which tracks 21 key developed market countries, has gained about 17.5% year-to-date in U.S. dollar terms. The MSCI EM index, which tracks emerging markets, has risen 10%.2 This has occurred despite global uncertainty due to trade.

Not only have these markets performed better this year, but valuation differences remain substantial. While the S&P 500 trades at elevated price-to-earnings ratios, international markets offer more attractive valuations, as shown in the chart above. This is partly due to political and economic challenges in many of these regions over the past ten years, some of which have begun to turn around.

One key difference between investing in the U.S. and internationally is that currency fluctuations can affect returns. In particular, the weaker dollar has created favorable conditions for U.S.-based investors. This is because foreign assets increase in value when the currencies they are denominated in strengthen, allowing them to be converted back to more dollars. This currency tailwind has been a meaningful contributor to the strong performance of international stocks this year, providing an additional boost beyond the underlying performance of foreign companies.

It’s important to diversify across regions and market capitalizations

For long-term investors, maintaining exposure to areas such as small-cap and international stocks can help create more balanced portfolios. This is especially true after the significant performance of large-cap stocks which have been driven by just a handful of the largest companies.

This is not to say that U.S. large caps will become less important. This is also not an argument for making significant changes to well-constructed portfolios. Instead, maintaining long-term portfolios is all about holding the right asset allocation across all these types of investments. By including more attractively valued parts of the market, we can potentially strengthen long run risk-adjusted outcomes, and take advantage of market opportunities. While any single asset class may underperform during certain periods, their different characteristics and return patterns can provide valuable diversification benefits over time.

The bottom line? While the S&P 500 and Dow remain important benchmarks, investors should consider the benefits of diversifying across many other parts of the market, including smaller companies and international stocks. Holding appropriate portfolios for the long run is still the best way to achieve financial success.

1. Russell 2000 and S&P 500, price returns, from January 2, 2015 to May 23, 2025

2. MSCI EAFE and MSCI EM, total returns, January 1, 2025 to May 23, 2025