There was a rapid sell-off in the markets at the end of last week, with the S&P 500 declining almost 6% from its recent peaks and the Nasdaq 100 experiencing an 11% drawdown and continuing today.

Following a notably stable year, the stock market has finally exhibited some volatility in the past week.

It is important to note that the abnormal calmness seen in the stock market in 2024 prior to the current correction was not sustainable. Corrections, such as the one currently being experienced, are a normal part of market cycles.

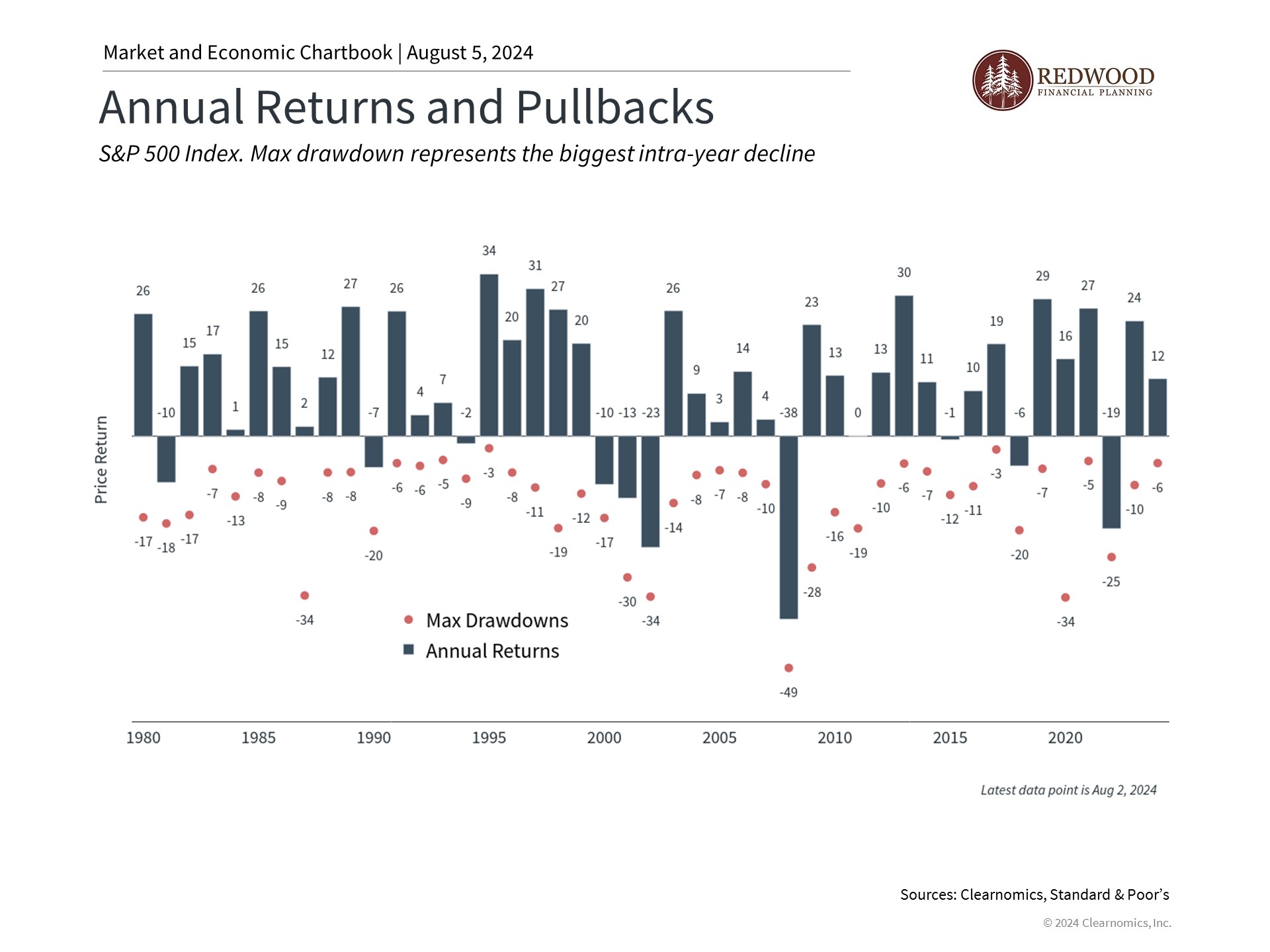

Historical data shows that market corrections are common occurrences. In fact, the U.S. stock market undergoes a correction almost every year, with a 5% downturn being prevalent in most years. Double-digit drawdowns happen in approximately two-thirds of all years since 1928.

|

- This chart shows the performance of the stock market (bars) and the largest intra-year decline (dots) each year.

- The average year sees a stock market drop of -13.5%. However, most years still end in positive territory, averaging 9% gains.

- Volatility is a normal part of investing and investors are often rewarded for staying disciplined through short-term volatility.

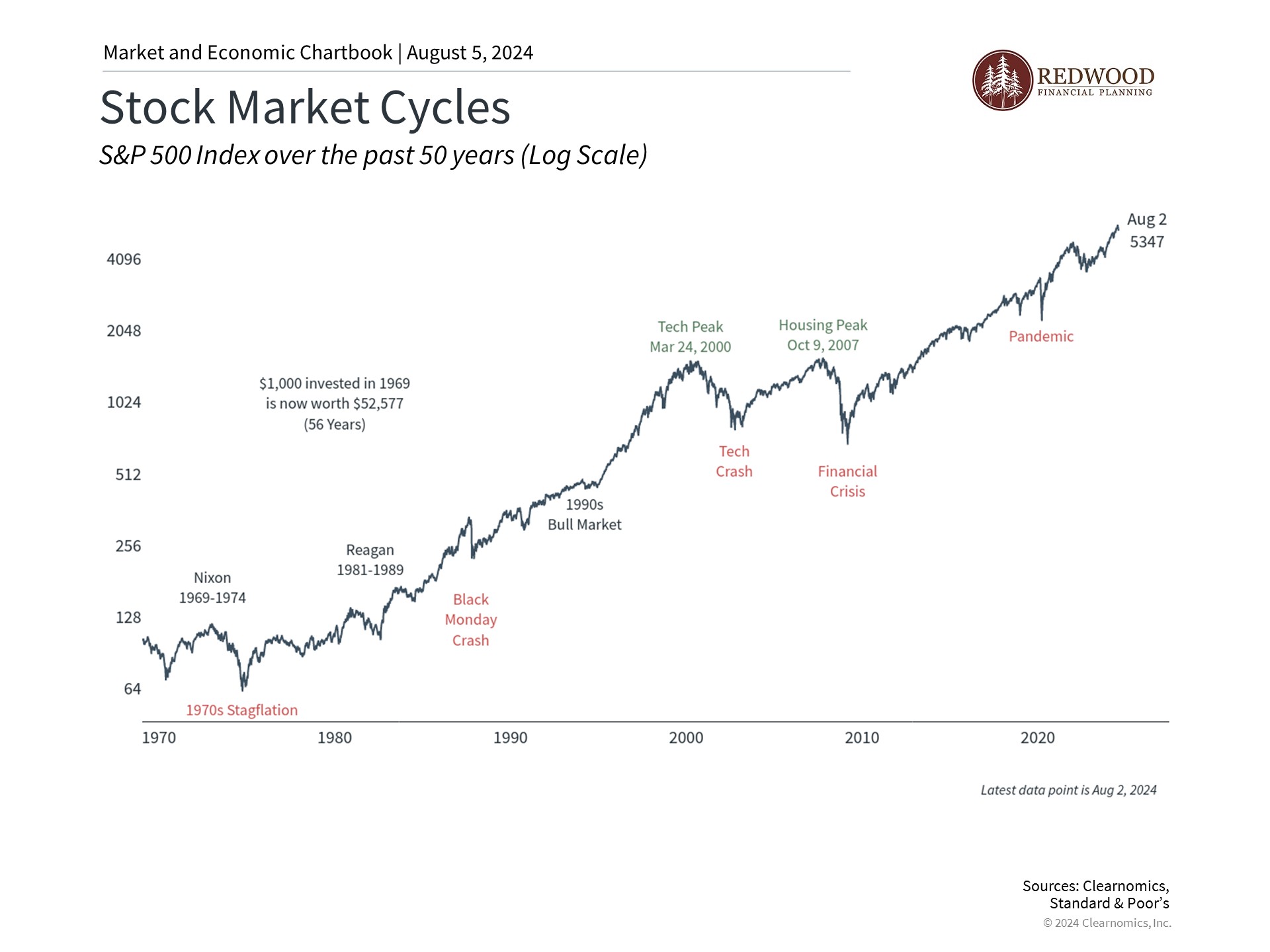

And as a reminder…. To invest in the stock market, requires a long term view. Things are always scariest during cycles of extreme volatility….but smooth out over time.

|

- As this chart shows, the stock market has performed well over the past 50 years despite short-term ups and downs.

- These periods of turbulence were due to economic, political and global turmoil during those decades.

- This emphasizes the importance of staying invested, rather than focusing on days or months, especially as volatility rises.

We are always here to discuss and talk thorough any challenges.