We have received important questions about trade policy and its potential impacts on markets and portfolios. With new trade tensions emerging between the U.S. and key trading partners, many investors are wondering how this might affect their investments. This topic is especially relevant given recent policy proposals and their potential effects on inflation, supply chains, and international commerce. Here are some key points to consider:

• Recent executive orders have imposed significant new tariffs, including 25% on Canadian and Mexican imports and 10% for Chinese products. Canadian energy will face a 10% tariff.

—delay with Mexico and Canada for 1 month

• These policies could lead to higher consumer prices, particularly for products like groceries, automobiles, and energy, since Canada supplies 60% of U.S. oil imports.

• Trading partners are already planning retaliatory measures, with Canada announcing $100 billion in counter-tariffs on U.S. goods including steel, aluminum and aerospace products.

• It’s important to remember that investors feared trade wars during the first Trump administration, but markets generally performed well. In many cases, these were negotiating tools to achieve new trade deals.

Regardless of how trade policies evolve, maintaining a well-diversified, long-term investment approach remains the best strategy for navigating periods of policy uncertainty and market volatility.

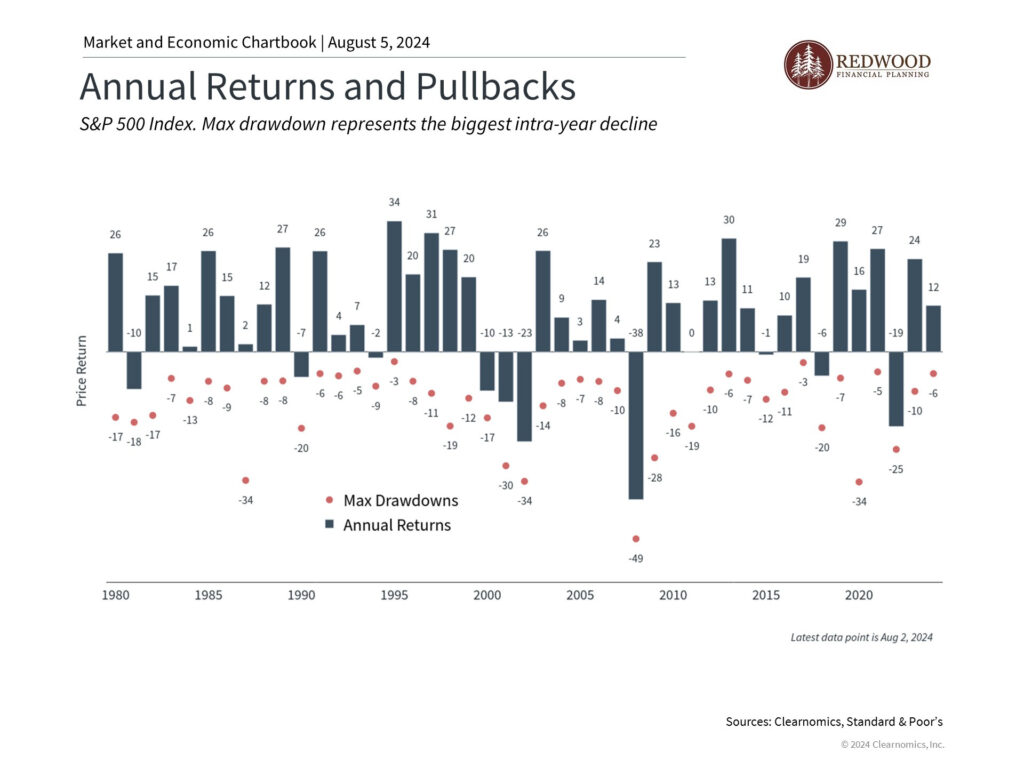

- This chart shows the performance of the stock market (bars) and the largest intra-year decline (dots) each year.

- The average year sees a stock market drop of -13.5%. However, most years still end in positive territory, averaging 9% gains.

- Volatility is a normal part of investing and investors are often rewarded for staying disciplined through short-term volatility.

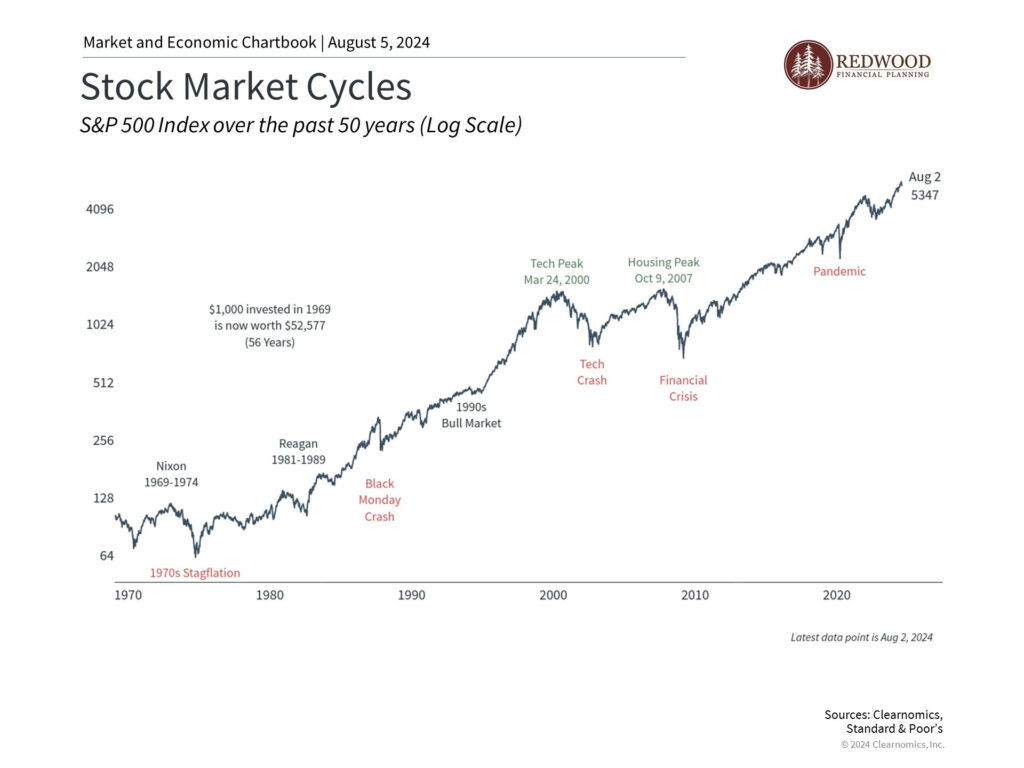

And as a reminder…. To invest in the stock market, requires a long term view. Things are always scariest during cycles of extreme volatility… but smooth out over time.

- As this chart shows, the stock market has performed well over the past 50 years despite short-term ups and downs.

- These periods of turbulence were due to economic, political and global turmoil during those decades.

This emphasizes the importance of staying invested, rather than focusing on days or months, especially as volatility rises.