We have all heard that in life moderation is key, well it should be no surprise that the-same holds true for investing.

To take extreme positions of being all in all or all out will always lead to financial distress!

When you go “ALL IN” you fully expose yourself to the risks of that investment—whether it’s stocks, bonds, real estate, wine, crypto—100% of one thing, is the riskiest form of investing.

Moderate investors are typically “middle of the road” risk-takers. They are aware that markets go up and down, and they’re content with that. A moderate investing strategy pursues long-term growth without going all-in on risk. It’s all about finding the right balance of risk/protection that works for you..

There is not one definition of a moderate investor. Investing is personal, and your ability to take risks depends on several factors. Even professional investment managers and large firms have different views on how much risk a moderate investor should take.

The bottom line is —once you take an extreme position it’s very hard to reverse. You mostly likely made a full commitment and that can lead to disastrous results.

It would be like trying to stop in mid air after you jump off a diving board into a pool…..

Here are some extreme examples—and the results…

- Going to cash in 2008 and missing out on a 10 year bull market…

- Going to cash in April 2020 and missing out on the largest rally of all time…

- Going all in on stocks in 2000 and getting smashed in the tech bubble…

- Buying all the real estate you can in 2007 to get whacked by the credit crisis…

The Psychology

When you go all “in” or “out” you take a such a strong stance, you are fearful of being wrong, having to back track, having to change. Selling your stocks that have lost value seems like a practical financial decision to make, but an overwhelmingly percentage of investors are loath to take action. Admitting your wrong is the first step to make the right choice for your portfolio when it comes to extreme investing.

In general, you’re a moderate investor if you want to grow your money without losing too much. The goal is to balance out opportunities and risks, and the approach is sometimes described as a “balanced” strategy. To pursue growth, you need to tolerate some losses, which tend to be temporary—but they can still be scary and unpleasant.

You can reduce that volatility and attempt to avoid losses by using an investment mix that includes relatively stable investments.

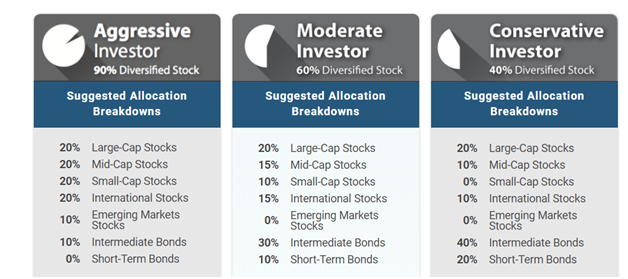

From The American Association of Individual Investors here are asset allocation models based on different risk levels

For a moderate investor this allocation provides a decent amount of exposure to the stock market without the risks of a 100% stock portfolio. The bond portion helps to smooth out the ups and downs of the stock market and can provide some income and “total return.”

Get Help With Your Portfolio

There are several ways to enlist the help of a professional:

- Get a quick review of what you’re currently doing (a one-time deal).

- Get ongoing investment management (if you want to be hands-off).

The major benefit of talking to someone is that they will hopefully talk you down from the ledge and prevent you from making the “all or nothing” decision. Instead you can dip a toe in and if the water is too cold,, you can pull it right out!

Cheers to financial success!