First, let’s get through the basics.

What is a Traditional IRA?

-A traditional IRA is a personal savings plan that offers tax benefits to encourage retirement savings.

Almost anyone can set up a traditional IRA. The only requirements are that you must have taxable income (typically, salary or wages from your job) and be under age 70½ in order to put money into an IRA.

You can contribute a total of $5,500 to all the IRAs you own (traditional and Roth) in 2016 (unchanged from 2015). Married couples may contribute $5,500 per spouse under certain conditions, even if one spouse has little or no income.

In addition, if you’re age 50 or older, you can make an extra “catch-up” contribution of $1,000 in 2015 and 2016. Your annual contribution can be made as a lump-sum payment or a series of payments, and can be made up until April 15 of the following year.

Although practically anyone with earned income who is under age 70½ can contribute the full $5,500 to an IRA in 2016, your ability to deduct contributions will depend on several factors (e.g., your adjusted gross income, your tax filing status, and whether you or your spouse is covered by an employer-sponsored plan).

You may be able to deduct all, a portion, or none of your IRA contribution for a given tax year.

You may even qualify for a partial tax credit. (discuss this with your CPA) Also, while the money is inside the IRA no tax is due.

To avoid a 10% withdrawal penalty, you must be over the age 59.5 to withdraw the funds from your IRA. There are exceptions to this rule that you can see here and we will go over on future posts. (3rd party websites are not endorse by IFS Securities)

When you withdraw money from your IRA all of the pre- tax contributions and earnings are fully taxable on the Federal and State levels.

Let me break it down:

Very Simplified Example (real results will vary)

Example: Earn $100,000 of income

Contribute $ 5,500 (max in 2016 if under 50 years old.+$1,000 if older )

Taxable income $ 95.000

Tax on $100,000 (25% tax bracket) = $25,000

Tax on $ 95,000 (25% tax bracket) = $23,750

Tax savings! > = $ 1,250 and you have another $5,500 in a bucket for your future!

Good deal!

Note:

The traditional IRA is NOT an investment, I repeat, it is not an investment. It’s the wrapper that you put investments inside of. You can put stocks, bonds, CD’s, mutual funds, ETF’s, savings accounts–all inside the IRA.Those investments are what grows or doesn’t grow. Not the IRA itself.

To keep our simplified example going:

Let’s say you put mutual funds inside your Traditional IRA.

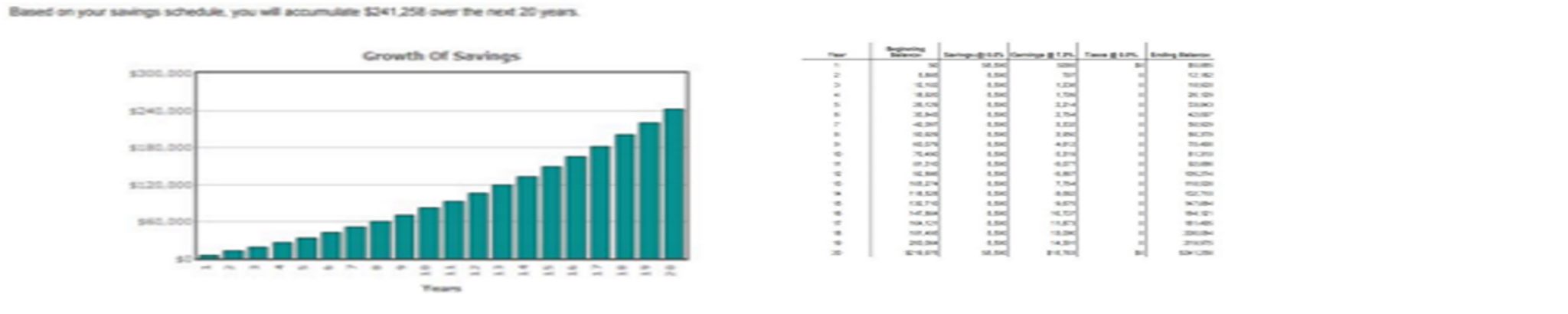

You do this for 20 years. $5,500 *20 = $110,000 of contributions

And over the next 20 years they earn on average 7%. (Not real results, hypothetical)

Your contributions will grow to $241,258

Is that good? I don’t know it all depends…check your financial plan to determine!

http://www.calcxml.com/

At this point you are done contributing to your IRA and it’s time to flip the switch. You are over 59.5 and it’s time to withdraw from your IRA to replace your earned income in retirement.

Be Warned!

Every dollar you take out of the IRA (pre tax contributions and earnings) will be fully taxable on the Federal and State level based on your ordinary income tax rate.

Whoa…

If you need the money to live, the recommendation is only take what you need out of the IRA on an annual basis and leave the balance. I repeat: You are only taxed on what you take OUT.

And, you are not required to take it all at once!

So Jared, what if I don’t need it at all—Aha!

You think you can just leave it in there forever don’t ya..

Well I hate to break it to you, but the IRS has thought of everything.

You actually can leave it ALL in there past age 59.5 without paying any tax or penalty.

But there is a cap AND a floor…

And that cap my friend, is age 70.5. Once you hit 70.5 years old, you are REQUIRED to start taking money out of your IRA.

How much?

That is the floor – the amount is based on your life expectancy and the value of your IRA’s and other retirement plan balances. (Required minimum distribution or RMD) Calculate your floor here (3rd party website not endorsed by IFS securities)

At this point you see…Your IRA starts to die.

Is this you? You have gotten so successful that you actually don’t need the money in your IRA. You are excited about the idea of leaving it to your spouse, kids or even grandkids to give them a great head start…But the IRS has other plans…and will slowly overtime whittle it down…until… it’s all gone…

I bet your thinking. Are there any alternatives? Can it be saved ?

Pull out the defibrillator and CLEAR!

I am here to tell you, YES.

I am going to outline 3 strategies to pull your IRA back from the brink! These are strategies I have used with existing clients to preserve their wealth and maximize the transfer to younger generations.

These strategies are generally best for those who do not need the assets in their Traditional IRA to replace their earned income. Through pensions, social security and other savings/investments they will replace their income and live out their golden years.

The 3 strategies are:

- Roth IRA Conversion

- Stretch IRA

- Life Insurance Conversion

**disclaimer: these are general strategies and you should discuss them with your tax professorial and financial planner BEFORE making any decisions

Roth IRA Conversion

First -Fun Facts You Need to Know about A Roth IRA (differences from Traditional IRA)

- Money is deposited after TAX— Example above –no $1,250 tax savings

- There are income limits to make new contributions every year

- There NO taxes due upon withdrawal (after 5 years of ownership)

- There are no Required Minimum Distributions at 70.5 or EVER

Those last 2 FACTs make the Roth IRA a dream retirement/legacy planning tool.

If you want your IRA to be forever free of the IRS, then it cannot be a Traditional IRA. It needs to be “converted” to a Roth IRA.

The process-

You contact the custodian where your current traditional IRA is held and you request the paperwork to convert it to a Roth. The money never actually has to leave the account. Just the title has to change.

What else happens?

Before you file your taxes, you will receive a Tax Form that spells out the change that took place.

That tells the IRS your IRA is now a Roth IRA.

Here is the rub-

When you convert funds from a Traditional IRA to a Roth IRA, the funds that you transfer are subject to federal income tax in the year you did the transfer. It is also recommended to pay the tax bill from funds outside of your IRA.

So to allow your IRA to be free from all future taxes, you have to give the IRS their taste today.

Example:

Traditional IRA value $241,258

Tax Bracket 25% = $ 60,314 < taxes owed today Pay from somewhere else.

Roth IRA value $241,258 growing tax free from this point on!

Bottom line—if you do not need the traditional IRA and you have significant wealth outside of the IRA, it might make sense to pay the IRS today and have your retirement money growing tax free from this point on.

Stretch IRA

What if I told you your IRA can last 20 years or 30 years or maybe even 40 years after you die?

Would you call me crazy? Would you tell me to get my head examined?

Well, ladies and gentleman, it’s possible and it’s not very hard to accomplish with some smart planning.

It’s called STRETCHING YOUR IRA!

All it takes is

- making sure you have a person listed as the primary and contingent beneficiary on all your accounts

- Self control!

The best way to explain a stretch IRA is with an example:

Case Study

- Bill dies at age 78 with an IRA worth $500,000.

- He had named his surviving spouse, 69-year-old Jane, as his sole beneficiary.

- Jane elects to roll over the funds to her own IRA.

- Jane names Jessica, her 44-year-old daughter, as her beneficiary.

- At age 70½, Jane begins taking required minimum distributions over a period determined from the Uniform Lifetime Table. (Jane is allowed to recalculate her life expectancy each year.)

- At age 79, Jane dies.

- The IRA now becomes Jessica’s who begins taking required distributions over her life expectancy–29.6 years (fixed in the year following Jane’s death).

- Jessica names Joseph her 30-year-old son, as her successor beneficiary.

- Jessica dies at age 70 after receiving payments for 16 years,

- Joseph continues receiving required distributions over Jessica’s remaining life expectancy (13.6 years). (See assumptions below.)

| Year 1 | Jane becomes owner of Bill’s IRA |

| Year 3 | Jane begins taking distributions at age 70½ over her life expectancy |

| Year 12 | Jessica begins taking distributions the year after Jane’s death over Rebecca’s life expectancy |

| Year 28 | Joseph begins taking distributions over Jessica’s remaining life expectancy |

| Year 40 | All of Luke’s IRA funds have been distributed |

Under this scenario, total payments of over $2 million are made over 40 years, to three generations.

Note: Payments from a traditional IRA will generally be subject to income tax at the beneficiary’s tax rate. Qualified distributions from a Roth IRA are tax free.

Assumptions:

- This is a hypothetical example and is not intended to reflect the actual performance of any specific investment portfolio, nor is it an estimate or guarantee of future value.

- This illustration assumes a fixed 6% annual rate of return; the rate of return on your actual investment portfolio will be different, and will vary over time, according to actual market performance. This is particularly true for long-term investments. It is important to note that investments offering the potential for higher rates of return also involve a higher degree of risk to principal.

- All earnings are reinvested, and all distributions are taken at year-end.

- The projected figures assume that Mary takes the smallest distribution she’s allowed to take under IRS rules at the latest possible time without penalty.

- The projected figures assume that tax law and IRS rules will remain constant throughout the life of the IRA.

So, $500,000 -> $2,00,000 over 40 years. Amazing.

Understand, at any point, anyone could have taken out the full IRA value (paid taxes) and ended the process right there. You are not required to continue the stretch at any point.

Killer

If your IRA’s do not have beneficiaries listed, upon your death, all of the money will have to come out of the IRA within 5 years so the IRS can get their taxes!. You will have killed your IRA.

Life Insurance Conversion

At this point we have established that for these strategies to have value, you did not need the money in your IRA. Unfortunately, after age 70.5 the IRS mandates you start taking money out so they can tax It, whether you need it or not.

This last strategy is designed to use the RMD to your advantage! And turn the tax infested IRA into a pure tax free legacy asset.

This is accomplished with the implementation of a life insurance policy purchased in a trust.;

How it works:

If you are insurable (you can still get life insurance and you do not have any health issues), you take the RMD from your IRA (pay taxes on it) and then use the balance to purchase a life insurance policy.

The RMD becomes the premium payment and because you didn’t need the money anyway, you can use to buy the life insurance policy. Exchanging the taxable asset with a tax free asset over time!.

At any point, if you were to pass away your family would receive the balance of the IRA plus the life insurance proceeds.

Oh by the way. life insurance passes to beneficiaries completely tax free (no income taxes) Life insurance owned by a trust is NOT included in the estate of the insured! (no estate taxes)

Boom and Boom.

Note:

You might want to consider starting this strategy before 70.5, because life insurance is very difficult (but not impossible) to acquire at that age.

Of course there are more nuances to this strategy that a qualified estate planning attorney and financial planner should be able to go over with you.

But my point is to make you aware of the option!

Wrap up:

After reading this post have you come to the conclusion that your IRA is dying?

If so, I hope you see value in the 3 strategies I outlined on how to pull your IRA from death’s door.

You have worked hard to grow your nest egg, no reason to just let it whittle away. You have options! Be proactive with your Financial Planning and maximize your wealth for AND your family. And I’m talking great, great grandkids.

As always, you can consult with me to discuss your IRA plans

Look for future posts on the best ways to build your nest egg and check out my recent post on global investing.

Thanks for stopping by and I hope you achieve financial success!

2 thoughts on “Is Your Traditional IRA Dying?”

Comments are closed.